Delivery company Instacart said Thursday that it will slash its valuation by nearly 40 percent as tech stocks continue to feel turbulence in the public markets.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

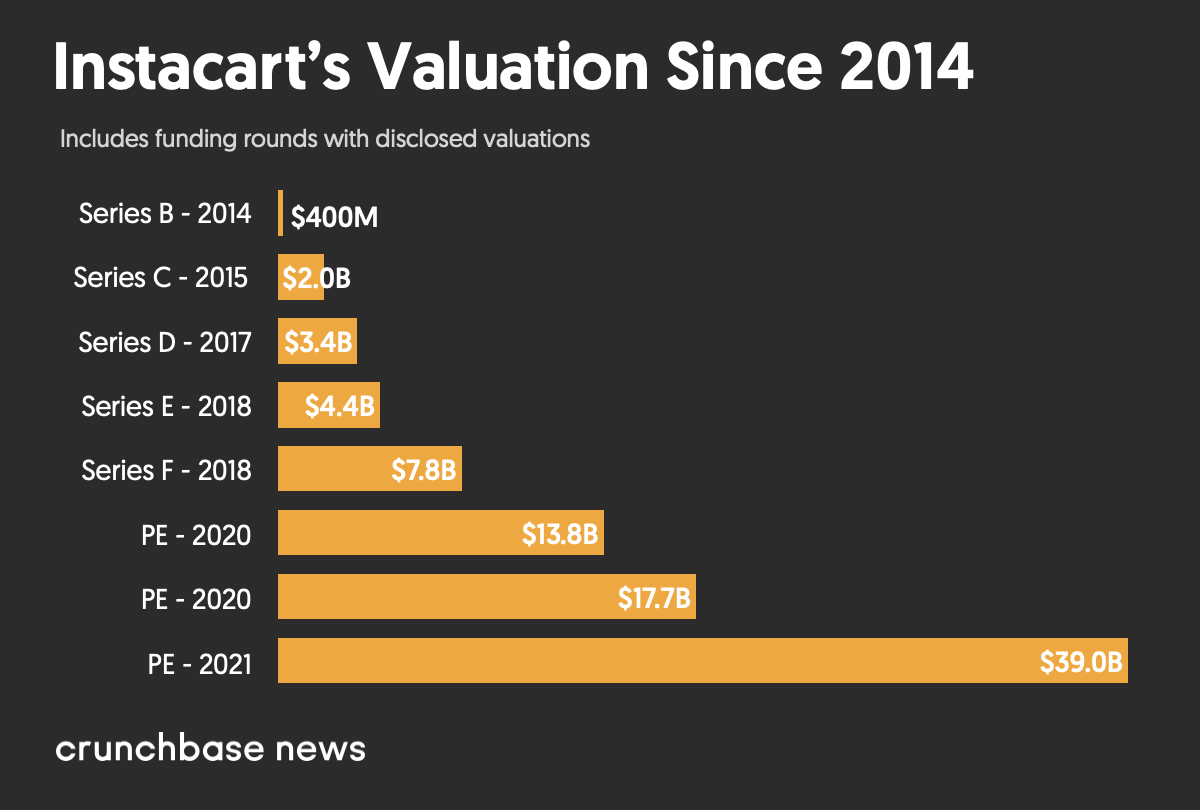

The cut, first reported by Bloomberg, brings Instacart’s valuation to $24 billion, down from the $39 billion price tag the company minted last year.

The move comes as tech stocks in general have been hammered by the public markets. Rising interest rates, inflation concerns and geopolitical issues have all contributed to a roller coaster for tech stocks.

Instacart saw a boom in business at the onset of the pandemic, as customers turned to grocery delivery to avoid leaving home. The company was also considered a candidate to go public soon, but IPO activity so far this year has been pretty quiet.

Founded in 2012, Instacart raised nearly $3 billion in funding as a private company.

It became a unicorn somewhere around 2015, with its valuation jumping from around $400 million in 2014 to more than $2 billion with a $220 million Series C in January 2015.

Since then, its valuation climbed to nearly $40 billion, before Thursday. Valuations were up across the board, but Instacart lowering its own valuation—an uncommon move by a company—follows valuations of publicly traded companies falling and more shares of startups selling for lower prices on the secondary markets.

Illustration: Li-Anne Dias

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

67.1K Followers