By Itay Sagie

Over the past couple of years, we have seen tremendous growth in tech funding, and unicorns today are anything but rare. But what is driving valuations up? In this article, I would like to review the current status and trends behind what seems to be an alarming increase in revenue multipliers.

Subscribe to the Crunchbase Daily

Revenue multipliers have more than quadrupled in the past three years

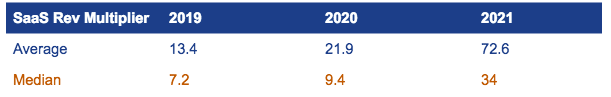

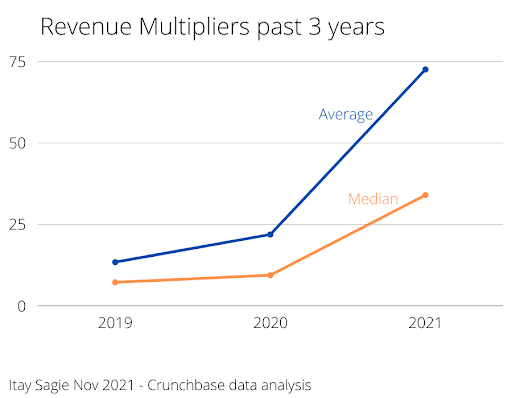

An analysis of 302 SaaS VC deals on Crunchbase that have data on valuation and estimated revenue, in the U.S., Europe and Israel over the past three years clearly shows an increase in revenue multipliers.

The median revenue multiplier in SaaS has grown from 7.2 in 2019 to 34 in 2021, while the average revenue multiplier has grown from 13.4 in 2019 to 72.6 in 2021.

The increasing gap between average and median shows the increased extremities in revenue multipliers over time, exceeding 100x revenue multipliers during 2021 on certain deals.

[Revenue multiplier is the ratio between valuation and revenues of a company at the time of sale.]

Abundance of growth-stage funding

What is causing the soaring revenue multipliers and should we be worried?

As Crunchbase New’s third-quarter global venture capital report shows, the percent of growth-stage funding is on the rise, large fundings of $100 million funding were responsible for the majority (64 percent) of global VC funding last quarter, and overall growth funding has also grown significantly.

This rise in growth-stage funding is also creating fierce competition among funds, driving an increase in valuations.

The search for the next trillion-dollar business

In 2018, we saw the first trillion-dollar company, Apple, which doubled in value in just two years to $2 trillion. Today, we have five companies valued at $1 trillion or more, four of which are tech companies and one an oil and gas company.

Most of the pending companies expected to exceed the $1 trillion valuation mark are also tech companies. This newly found growth potential has made growth-stage companies even more attractive. VCs and PEs are actively searching for the next trillion dollar company, which may justify high revenue multipliers.

How alarming is this trend?

I cannot disagree with the notion that these high multipliers are disproportional, but, unlike the past, the type of companies that “enjoy” the high revenue multipliers today have more to do with B2B SaaS vs consumer products.

In most cases, there is a valid business model, and higher business merit. I also trust that some do have the ability to become billion-dollar businesses (perhaps trillion-dollar businesses) not just on paper, and that may prove profitable for VC funds.

Opportunity for the future

In my opinion, the future VC strategy, which is also starting to become utilized in a few funds, is to focus on “data-driven funding.” It does take discipline, but in the long run I believe this approach will reduce bias, focusing on healthy unit economics, fundamentals and sustainable growth, resulting in potentially higher ROI.

Itay Sagie, a guest contributor to Crunchbase News, is a lecturer and strategic adviser to startups and investors on strategy, growth and M&A. He founded VCforU.com, recently acquired by Gusher, and Sagie Consulting. You can connect with him on LinkedIn and follow him on Twitter at @itaysagie.

Illustration: Li-Anne Dias.

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

67.1K Followers